-

Home

-

Data

-

JICMAIL Discovery 3.0

-

News

- WEBINAR: Using JICMAIL Discovery - Refresher

- NEWS: JICMAIL supporting Media Mind

- PARTNER WEBINAR: Using Mail's Super Touchpoint Powers to Achieve Awards Success

- NEWS: Q4 2024 Results - Mail read rates hit an all-time high as the channel continues to assert its Super Touchpoint strengths

- WEBINAR RECORDING: JICMAIL Quarterly Results: Exploring Mail's Super Touchpoint Strengths in Q4 2024

- NEWS: Mail stakes its claim as a Super Touchpoint channel with the release of new JICMAIL paper

- JICMAIL Conference 2025: The Rise of the Super Touchpoint

- NEWS: JICMAIL announces the latest winners of the JICMAIL Platinum Awards for outstanding practice with JICMAIL data (2)

- NEWS: Q3 2024 Results: Mail proves its sustainability credentials with +14% growth in recycle rates

- WEBINAR RECORDING: Q3 2024 Results: Mail and the Value of Creativity

- WEBINAR: Mission Driven Mail - Exploring mail in the mix for government marketing campaigns

- NEWS: JICMAIL and Origin conduct mail measurement pilot study

- PARTNER WEBINAR: Elections: How much does mail matter?

- PARTNER EVENT RECORDING: IPA Effectiveness Conference 2024 - Experimentation! Experimentation! Experimentation!

- PARTNER EVENT: DMA Value of Creativity

- PARTNER EVENT RECORDING: BPIF & JICMAIL Future Growth Roundtable: Understanding a customer's need for variable digital print

- PARTNER EVENT: The Power of Print 2024

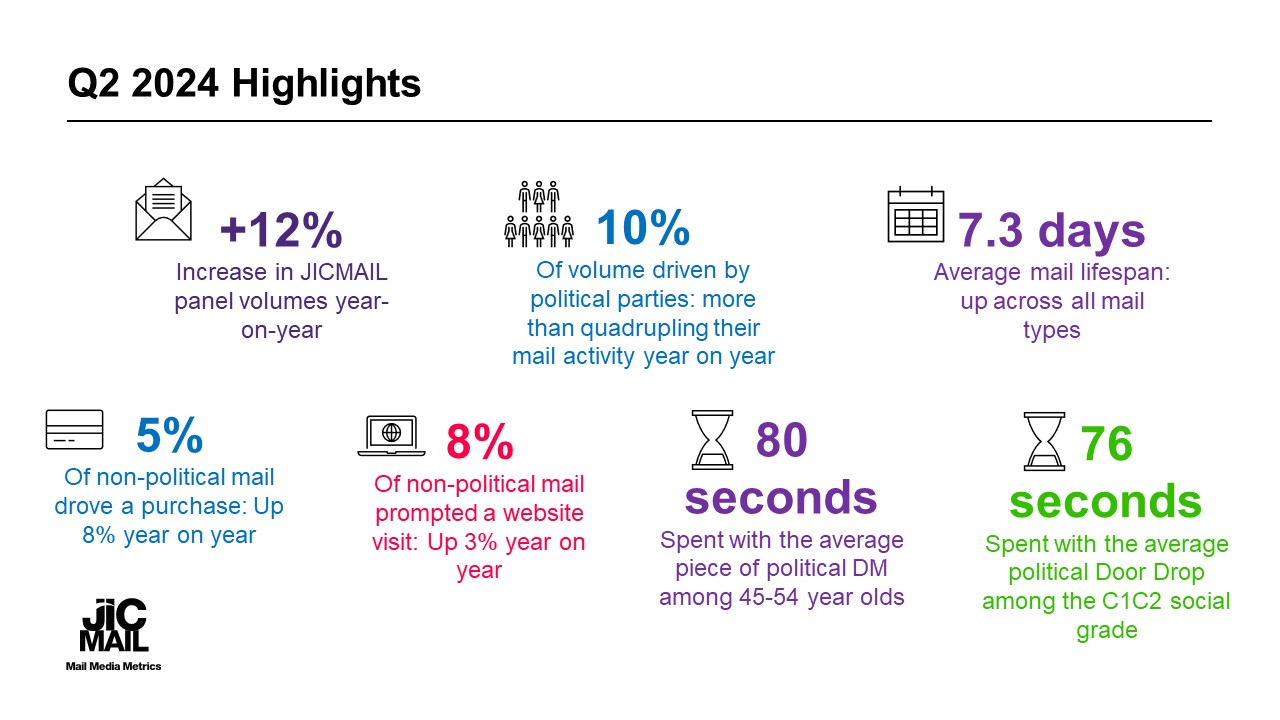

- NEWS: Q2 2024 Results - The General Election drives a 12% increase in JICMAIL panel volumes in Q2 2024

- WEBINAR RECORDING: Q2 2024 Results - Exploring the impact of the UK’s snap election on mail performance

- PARTNER WEBINAR: Mastering Direct Mail - A Six-Step Approach that delivers a great ROI

- NEWS: Include JICMAIL data in your DMA Awards entry

- NEWS: Are you entering the SMP Awards 2024?

- SPOTLIGHT: DMA Awards 2023 - GOLD Award for the Mail Category - PSE

- WEBINAR RECORDING: Insights for Christmas 2024 retail and supermarket campaign planning

- DMA/JICMAIL Door Drop Report 2024

- NEWS: Mail response and attention continue on an upward trajectory in Q1 2024

- WEBINAR RECORDING: Q1 2024 Results - Applying the new Response Rate Tracker benchmarks

- PARTNER REPORT: DMA's Value of Measurement Report

- WEBINAR RECORDING: From Letterbox to Ballot Box - Reclaim Voter Trust

- PARTNER EVENT: From Brand to Hand: The Ultimate Direct Mail Workshop

- NEWS: JICMAIL scales up its Response Rate Tracker for 2024

- WEBINAR RECORDING: The Power of Retail Media and Mail

- NEWS: Q4 2023 Results: 40% of website visits prompted by mail converted into online purchases

- WEBINAR RECORDING: Q4 2023 Results: Test & Learn on the Path to Digital Conversion

- PARTNER WEBINAR RECORDING: How to get your award-worthy mail campaigns recognised

- PARTNER EVENT: Sagacity - Direct Mail Marketing 101 for Charities

- PARTNER EVENT: The Ultimate Direct Mail Workshop - with Epsilon and Webmart

- PARTNER BLOG: How will the UK’s data privacy reforms impact marketing?

- ADWANTED BLOG: Six no-nonsense steps for marketers building a measurement framework

- WEBINAR RECORDING: Q3 2023 Results - A first look at our new metrics plus how to build the case for mail

- NEWS: Q3 2023 Results - Mail’s effectiveness at the sharp end of the multichannel purchase journey increases in Q3 2023

- NEWS: JICMAIL Discovery 3.0 is now live!

- NEWS: JICMAIL announces the latest winners of the JICMAIL Platinum Awards for outstanding practice with JICMAIL data (1)

- JICMAIL Annual Conference 2023: Measurement and Attention - Why it matters for mail

- PARTNER WEBINAR: Discover the Power of Direct Mail

- VIDEO: Creativity, collaboration & communications: the journey of Creative Futures

- PARTNER WEBINAR: Best Practice Measurement for Owned Channels - Learn how to integrate your owned channels into your measurement plans

- EVENT: Putting theory into practice: How to build an effective marketing measurement framework

- PARTNER EVENT: Power of Print Seminar

- VIDEO: Top Tips for Mail and Unaddressed Print & Door Drops Category Entries

- WEBINAR RECORDING: JICMAIL Q2 2023: Announcing new targeting solutions for mail as ad mail effectiveness grows

- NEWS: Q2 2023 Results: Questions over whether the embattled British high street is making the most of the mail channel as mail effectiveness reaches a six-quarter high

- Partner Content: The Drum and Canon Europe offer one lucky UK SME the chance to run a marketing campaign – for free

- PARTNER WEBINAR: Discover the Latest Media Attention Metrics for Mail

- EVENT: Adwanted's The Future of Media

- GUEST BLOG: Consumer Duty : The HomeServe Experience

- PARTNER CONTENT: Postal Hub Podcast - Next-gen mail measurement with JICMAIL and Kantar

- PARTNER CONTENT: Compare formats across the life cycle of mail

- WEBINAR RECORDING: Retail Mail Effectiveness webinar - improving mail effectiveness plus Q1 2023 update

- NEWS: Q1 2023 Results: Mail engagement and effectiveness reached their highest level in a year

- PARTNER CONTENT: Mail Unleashed - Pete Markey, CMO Boots UK

- NEWS: Door Drop Report 2023

- IPA NEWS: New white paper makes powerful case for JICs’ pivotal role in era of data abundance

- ISBA BLOG: Acquisition more expensive than retention? It’s a matter of semantics…

- EVENT RECORDING: Adwanted's The Future of Brands

- WEBINAR RECORDING: The role of mail in the FCA's Consumer Duty shake up

- PARTNER WEBINAR: Supercharge your DMA Award entries with JICMAIL

- PARTNER CONTENT: Collaboration for Creativity

- WEBINAR RECORDING: JICMAIL Q4 2022: Launching the new Response Rate Tracker

- NEWS: Q4 2022 Results: Mail open, read, and in-home retention rates all improve over the course of the crucial Q4 trading season in 2022

- PARTNER CONTENT: Mail Unleashed - Lis Blair, MoneySuperMarket

- JICMAIL awarded Highly Commended for Media Owner/Trade Body of the Year at Mediatel Media Research Awards 2023!

- JICMAIL shortlisted in the prestigious Mediatel Media Research Awards 2023 for Media Owner/Trade Body of the Year

- GUEST BLOG: ChatGPT's 10 second take on JICMAIL

- WEBINAR RECORDING: Q3 2022 Results: How much attention do customers pay to your mail?

- NEWS: Q3 2022 results: With 250,000 mail items now measured JICMAIL reveals significant increases in mail engagement and effectiveness as the cost of living crisis deepens

- GUEST BLOG: If mail gets the most attention, why aren’t marketers giving it more attention?

- JICMAIL announces the latest winners of the JICMAIL Platinum Awards for outstanding practice with JICMAIL data

- JICMAIL Measurement Matters Conference 2022

- Do you have an entry for "Trailblazing Mail"?

- Creative Futures: Omnichannel Marketing Excellence Award

- BLOG: The WHO, HOW and WHAT of Creativity - Patrick Collister

- We're the DMA Awards 2022 Measurement Partner

- NEWS: Q2 2022 results: JICMAIL celebrates five years by revealing the increasing relevance of mail in peoples’ lives and growing connections in a digital world

- WEBINAR RECORDING: Travel Mail Insight: making mail work harder in challenging times

- NEWS: JICMAIL announces the latest winners of the JICMAIL Platinum Awards for outstanding practice with JICMAIL data

- NEWS: ISBA blog on JICMAIL Essentials

- WEBINAR RECORDING: Q1 2022 Results: Exploring why advertisers show confidence in mail in economically uncertain times

- NEWS: JICMAIL Q1 2022 results: Mail volumes up to their highest level in two years while the commercial effectiveness of the channel is maintained

- PLATINUM PARTNER BLOG: Should a compelling CX strategy focus on more than digital transformation?

- RECORDING: Mediatel's The Future of Brands 2022 - JICMAIL Panel Session

- WEBINAR RECORDING: Telecoms Insights: The role of mail on the path to Telecom Marketing Effectiveness

- NEWS: Q4 2021 results: Mail drives vital digital traffic and store footfall in the key Christmas trading period

- WEBINAR RECORDING: Q4 2021 Results Webinar: Mail's digital and physical effectiveness in Christmas 2021

- JICMAIL Customer Survey 2021 - 84% of JICMAIL subscribers are using JICMAIL to pitch for new business or campaign budget

- NEWS: JICMAIL announces the first ever winners of the JICMAIL Platinum Awards for outstanding practice with JICMAIL data

- NEWS: Q3 2021 results reveal mail reaches a mobile tipping point with record levels of digital activity

- WEBINAR RECORDING: Q3 2021 Results: Unveiling the new JICMAIL Test and Learn Toolkit

- WEBINAR RECORDING: JICMAIL Finance Insights: mail engagement, brand trust and customer loyalty for banking and insurance brands

- Your new Competitor Insight Tool

- WEBINAR RECORDING: Q2 2021 Results: Introducing unrivalled competitor insights for mail

- NEWS: Q2 2021 results reveal the crucial role mail played in encouraging consumers back in store as lockdown restrictions eased

- WEBINAR RECORDING: Q1 2021: Improved mail effectiveness seen throughout the customer journey

- NEWS: Q1 2021 results point towards improved mail effectiveness in the most recent lockdown

- VIDEO RECORDING: JICMAIL & Sky at Mediatel's Future of Brands 2021

- WEBINAR RECORDING: How to get Gold with JICMAIL - Parts 1 & 2

- WEBINAR RECORDING: JICMAIL Christmas Insight - exploring mail's role in driving shoppers back in-store

- WEBINAR RECORDING: JICMAIL Q4 2020: How have multichannel mail behaviours changed in a year like no other?

- NEWS: JICMAIL Q4 2020 results reveal that mail is driving commercial impact with even greater efficiency

- NEWS: IPA back widening access to JICMAIL

- BLOG: Busting some myths about young people and their mail

- NEWS: ISBA blog on the new JICMAIL Levy

- WEBINAR RECORDING: JICMAIL Q3 2020: News, tools and insight for mail in 2021

- WEBINAR RECORDING: See the changes in mail behaviours across lockdown with the latest Q2 JICMAIL data and review the lessons learned

- NEWS: JICMAIL Q3 2020 results reveal a +33% growth in web visits attributed to ad mail

- WEBINAR RECORDING: Putting mail on the media plan: Key learnings from government and public sector ad mail

- JICMAIL Customer Survey July 2020 - Results

- WEBINAR RECORDING: 9 Charity Ad Mail Myths busted by JICMAIL

- NEWS: It turns out that we did all read Boris’s letter.

- NEWS: JICMAIL Q2 2020 results reveal record levels of consumer interaction with mail during lockdown

- WEBINAR RECORDING: Planning for Christmas with JICMAIL – For supermarkets, retailers and their agencies

- WEBINAR RECORDING: Improving econometrics with JICMAIL

- BLOG: Working from home? Ad mail always has been...

- WEBINAR RECORDING: Using JICMAIL on your journey to the DMA Awards

- WEBINAR RECORDING: 7 Essential Insights on Business Mail

- PODCAST: Paragon Sounds Podcast Episode 4 "Innovations in mail planning data" With Ian Gibbs from JICMAIL

- BLOG: Blimey, a JIC with useful bells-and-whistles

- WEBINAR RECORDING: 7 Essential Insights on Partially Addressed Mail

- BLOG: Time for mail to make an impression in the short and long term

- VIDEO: JICMAIL & Econometrics at Mediatel's Future of Brands

- NEWS: JICMAIL’s impact assessed one year on

- BLOG: Insight, idea and impact

- EVENT: Planning with JICMAIL in a multi-channel world

- BLOG: Unhealthy targets?

- WEBINAR RECORDING: 5 steps to applying mail insight with JICMAIL Discovery

- BLOG: Time to get planning with JICMAIL

- NEWS: PrintPower article featuring Gavin Wheeler on the relevance of JICMAIL

- WEBINAR RECORDING: Multi-channel planning with JICMAIL

- NEWS: JICMAIL winner at MRS Awards!

- NEWS: JICMAIL Finalist in Mediatel Media Research Awards 2019 for Trade Body of the Year

- BLOG: Revisiting the measurement of mail in econometric models

- NEWS: JICMAIL Highly Commended at MRG Awards

- BLOG: Improving the clarity of mail performance for brands

- NEWS: Two Sides: Proving the Power of Mail

- BLOG: Keeping constant in the face of change

- BLOG: Time to acknowledge the true reach of your door drop campaign – it’s bigger than you think!

- REVIEW: Highlights for Retail / Online Retail Advertising Mail v Christmas 2019

- IPA White Paper: Living with the Pandemic in October 2021

- PARTNER EVENT: IPIA Conference 2024 - Ahead of the Curve

- IPA REPORT: Making Effectiveness Work

- PARTNER EVENT: IPIA sets out to foster industry growth at Recognising Excellence

- JICMAIL Highlights

- BLOG: The Media Leader - Super touchpoint planning: Teaching new dogs old tricks

- PARTNER EVENT: From Ink to Impact

- PARTNER NEWS: PrintGreen to drive sustainable marketing decisions

-

Resources

-

Training

-

About

-

Partner Tools

-

Contact

JICMAIL, Rapier House, First Floor, 40 Lamb’s Conduit Street, London, WC1N 3LB. Company no 4123433